אם ניסיתם להיכנס לאתר Sdarot TV וזה עדיין לא עובד, זה המקום בשבילכם. כאן תמצאו מגוון קישורים שיובילו אתכם לכמה מהאתרים הטובים ביותר של סרטים וסדרות באנגלית ובעברית.

כאן ניתן לכם את כל המידע הדרוש לצפייה בכל הסדרות שתוכלו למצוא באתר סדרות הטלוויזיה ובאפליקציות הנייד שלו. יש גם הוראות שלב אחר שלב כיצד לצפות בסדרות בחינם.

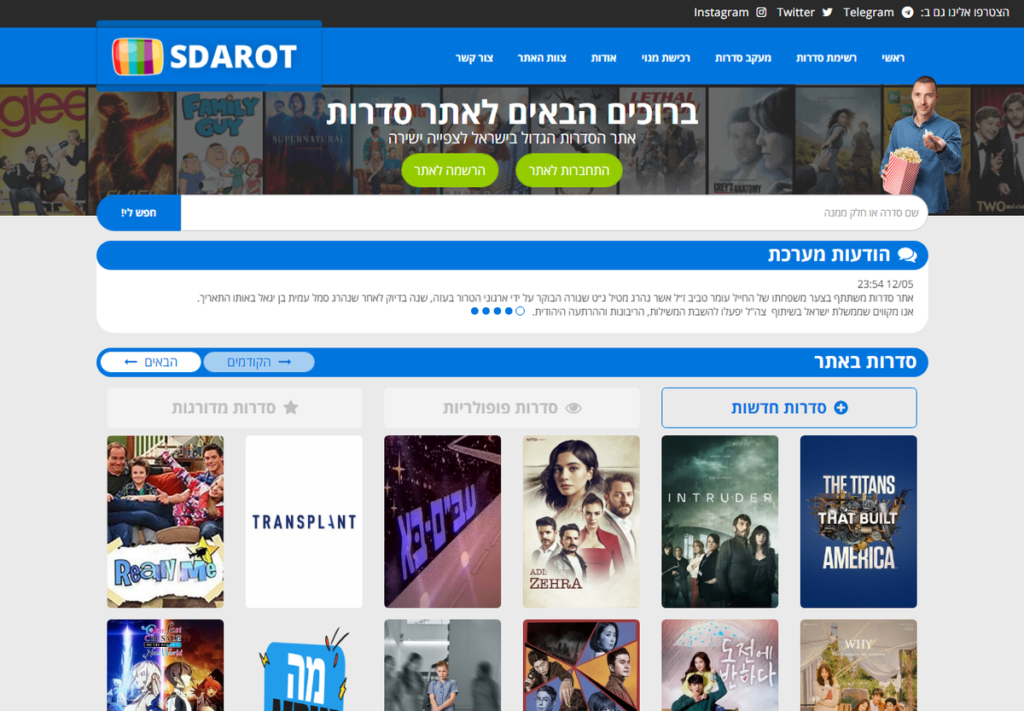

אתר סדרות טי וי נחשב לאתר הפופולרי בישראל לצפייה ישירה בסדרות בעברית ובאנגלית. כל הסדרות באנגלית ניתנות לצפייה עם תרגום מובנה בעברית. אתר Sdarot TV מאפשר גם לצפות בכל סדרות הדרמה הקוריאניות הפופולאריות. מדובר באתר שהפך את הצפייה בסדרות מכל העולם לפשוטה ונגישה לכולם.

ילדים, נוער ובוגרים שרוצים להעביר את זמנם הפנוי בהנאה במקום להשתעמם מבלי לעשות דבר, לרוב בוחרים לצפות בתכנים שמופיעים באתר. לכל אחד יש את הז׳אנר שיותר מושך ומעניין אותו. יש כאלה שמעדיפים לצפות בקומדיה, ואילו אחרים תמיד יעדיפו לצפות בסדרות דרמה. בכל אופן, אנו ממליצים לכם לעשות שימוש אך ורק בשירותי סטרימינג בתשלום כמו נטפליקס אשר נחשבים לחוקיים, כאשר המחיר של שירותי הסטרימינג היום זולים מאוד וכך תהיה לכם אפשרות לתמוך ביוצרים של התכנים הללו.

אתר סדרות החדש צפיה ישירה sdarot tv

בשנת 2022 הושק האתר החדש של אתר סדרות טיוי ומאפשר צפיה ישירה בכל תכני sdarot tv ללא הפרעה ובחינם.תגללו למטה והכנו לעשרות קישורים עדכניים לשנת 2023 שהכנו לכם שיאפשרו לכם לצפות באתר סדרות עם הלינק החדש

קישורים עובדים לצפייה ישירה סדרות טי וי :

עקב המאבק המשפטי המתנהל בימים אלה בישראל בנוגע לשידור תוכניות טלוויזיה, חלק מהקישורים ששימשו לעבודה הוסרו מהאתר.

שימרו על קשר איתנו. אנו נעדכן את הקישורים מדי פעם.

זהו האתר הרשמי של סדרות טיוי Sdarot וזה המקום הטוב ביותר להתחיל בו אם אתה רוצה לגשת לפלטפורמה. האתר מספק למשתמשים דרך מאובטחת ואמינה לצפות בתוכניות והסרטים האהובים עליכם.

כיצד לצפייה ישירה sdarot tv סדרות טי וי

השימוש ב סדרות טיוי הוא פשוט. התהליך דומה במכשירים שונים. בחלק זה, נספק לך מדריך שלב אחר שלב כיצד להשתמש לצפייה ישירה sdarot tv סדרות טי וי

- בחר קישור אחד מבין הקישורים הטובים ביותר שלמעלה.

- צור חשבון

- בחר את הסדרה או הסרט שברצונך לראות.

- התחל לצפות בסדרה או הסרט.

באתר הסדרה

שדרות TV הוא האתר הפופולרי ביותר בישראל לצפייה. כל תוכניות הטלוויזיה שלו הן בעברית ובאנגלית. האתר מאפשר גם גישה למשתמשים לסדרות הדרמה הקוריאניות השונות. באמצעות אתר זה תוכלו לצפות בקלות בכל הסדרות הפופולריות בעולם.

רוב האנשים שמשעמם להם לצפות בתכני טלוויזיה ורוצים לבלות את זמנם הפנוי במשהו פרודוקטיבי. בדרך כלל הם צופים במספר סוגי התוכניות שיש לאתר sdarot להציע. יש מגוון ז'אנרים שאנשים נהנים לצפות בהם, כולל דרמה וקומדיה.

למרות שניתן לצפות בסדרות של sdarot tv בחינם באתר, אנו ממליצים בחום להשתמש בשירות סטרימינג בתשלום כמו נטפליקס. זה מאפשר לך לתמוך ביוצרי התוכניות שאתה צופה בהן.

מדוע אתר סדרות tvכל כך מצליח?

אחת הסיבות העיקריות שאתר סדרות טי וי כל כך מצליח זה שהוא פשוט לשימוש. אנשים שמחפשים דרך לצפות בצורה לא חוקית בסדרות פשוט ניגשים אל האתר ומחפשים בו כל סדרה שמעניינת אותם ומוצאים אותה בקלות. למרות זאת, חשוב להדגיש כי אנו מאמינים בתמיכה ביצירה המקומית ואנו ממליצים בחום להימנע משימוש באתרים פיראטיים.

כפי שאפשר לראות, האתר פועל עכשיו על כתובות רבות ולא על סיומת ישראלית של co.il וזאת כדי שלא תהיה לארגון האינטרנט הישראלי או בית המשפט גישה לתכנים שלו. כך הוא מצליח להמשיך לפעול למרות שהוא אינו חוקי על פי מה שנקבע בישראל.

ישנה גם אפשרות לשלם לאתר ולעשות מנוי, כך שלא תצטרכו להמתין בכל פעם שאתם רוצים לצפות בפרק חדש. לחכות 30 שניות לפני כל פרק זה אמנם לא הרבה זמן, אך מנוי כזה יכול להתאים גם לאנשים שרוצים לתרום את כספם לצוות האתר על העבודה שהוא עושה. לצד זאת, תוכלו לבחור להשתמש בשירות סטרימינג חוקי כמו נטפליקס וזאת אם תרצו לתמוך ביוצרים של הסדרות והסרטים. זו ההמלצה שלנו.

חלק מאתרי סדרות סדרות טיוי, לא עובדים

סדרת טלוויזיה קישור של sdarot.website

סדרת טלוויזיה קישור של sdarot.series

סדרת טלוויזיה קישור של sdarot.tv

על סדרת טיווי

זהו האתר הפופולרי ביותר בישראל לצפייה בסרטים וסדרות בחינם.

בשנת 2022, אתר סדרות tv כלל למעלה מ-7000 סרטים טי וי ועוד מגוון רחב של סדרות בשפות שונות. התעבורה היומית שלו גדלה כל הזמן עקב אלפי הגולשים המשתמשים בו.

מאז תביעת זכויות היוצרים שהתרחשה ב-2021, אנשים רבים שהשתמשו בעבר באתר SDAROT כדי לצפות סרטים טי וי ויאחרים אֲתַר המספקים גם הם תוכן דומה פנו לשיטות אחרות כדי לצפות בתוכניות האהובות עליהם.

את הסדרות השונות המופיעות כיום באתר ניתן למצוא בערוצים ייעודיים שונים במדינות שונות.

Sratim.TV מתכננת גם להשיק אתר חדש בשנה הנוכחית 2022, שיאפשר למשתמשים לצפות בסרטים בשפת האם שלהם.

טיפים לשיפור חווית הטלוויזיה שלך בסדארוט

- נקה את המטמון ואת קובצי הcookie באופן קבוע כדי למנוע בעיות חציצה.

- עדכן את האפליקציה או התוכנה של Sdarot סדרות tv לגרסה העדכנית ביותר כדי להבטיח שיש לך גישה לתכונות העדכניות ביותר ולתיקוני באגים.

- נסה להשתמש בשירות VPN כדי לגשת לתוכן מוגבל גיאוגרפית.

- אם אתה נתקל בבעיות כלשהן במהלך השימוש ב Sdarot פנה לצוות תמיכת הלקוחות לקבלת סיוע.

אודות SDAROT TV ו- SRATIM TV

האתר, שהושק בשנת 2022, פירט את האתרים השונים המספקים שירותי צפייה ישירה בסרטים בישראל בשנים האחרונות. דרך מדור סרטי הטלוויזיה באתר, משתמשים יכולים למצוא בקלות מגוון רחב של סרטים הזמינים ממדינות שונות.

Read More About Sratim TV

תמיד עדיף סטרימינג – כך תתמכו ביוצרים

לפני תחילתו של עידן הסטרימינג, בו כולם כמעט צופים בסרטים דרך נטפליקס, היו המוני אתרי לא חוקיים דרכם היה נהוג לצפות בסדרות וסרטים מכל סוג. כך למשל, אתר סדרות טי וי מאפשר לאנשים לצפות בכל הסדרות והסרטים הפופולריים. לצד זאת, בשלב מסוים האתר המקורי כבר חדל מלפעול והבעלים של Sdarot tv החליט למקם את האתר שלו על מספר דומיינים אחרים ובחר חברות אחסון שלא פועלות בישראל.

לאור זאת הוראות של בית המשפט לא מצליחות להשפיע על האתר והוא ממשיך לאפשר לכל המעוניין לצפות בתכנים ללא שום בעיה. בכל אופן, יש לומר שעדיין מדובר באתר לא חוקי על פי בית המשפט בישראל ולאור זאת נמליץ לכם לבחור בשירות סטרימינג כמו נטפליקס כדי לצפות בתכנים שמעניינים אתכם.

מהו אתר SDAROT TV

SDAROT הינו אתר המציע חווית צפייה ישירה של סדרות שונות מהארץ ומחו"ל, במגוון רחב של ז'אנרים והתאמות לקהלי יעד שונים, בניהם משפחה, ילדים, הגיל הרך ועוד.

לכל הסדרות מחו"ל הנמצאות באתר SDAROT, מצורפות כתוביות בשפה העברית (נקרא גם "תרגום מובנה"). גם בסדרות הישראליות קיים תרגום ברוב המקרים. אתר סדרות מתעדכן על בסיס יומי, מאפשר צפייה ישירה מכל זמן ומקום בעולם, בחינם וללא הגבלה! צוות אתר סדרות שם דגש על שימוש בטכנולוגיות חדשניות על מנת להעביר לצופים את התוכן באיכות מקסימלית, ללא פשרות.

SDAROT TV לא עובד אצלך?

למרבה הצער, לפעמים, אתר הסדרות של SDAROT TV יכול להיתקע או לא לעבוד כמו שצריך. במאמר זה נדבר על מספר שלבים שיעזרו לך לפתור את הבעיה.

להלן פתרונות עבור הגישה לאתר אצלכם

7 פתרונות לגרום לאתר SDAROT TV לעבוד כמו שצריך

1. בדקו אם האתר פועל

First, make sure that the Sderot TV series website is still active. If not, try navigating to the other sites that currently offer movie streaming services.

2. פתיחת האתר ממכשירים שונים ודפדפנים שונים

לאחר בדיקה של השיטות השונות המשמשות לגישה לאתר סדרת אתר סדרות טי וי שחלק מהקישורים יפעלו לפתע במכשירים שונים.

3. גלישה במצב נסתר במצב גלישה בסתר

על מנת לשמור על המידע הפרטי של האתר, ניתן להשתמש בתכונה מיוחדת הכלולה בדפדפן או בגרסת המחשב של אתר סדרות טי וי. כדי לגשת לאתר באופן אנונימי, עבור אל כפתור ההגדרות ולחץ על "גלישה בסתר".

אתה יכול גם להיכנס לגלישה במצב נסתר על ידי לחיצה על: Ctrl + Shift + n

4. שימוש בקבוצת SDAROT TV Telegram

אם אתה רוצה להתעדכן בעדכונים האחרונים באתר SDAROT TV, אז אתה יכול להשתמש בקבוצת הטלגרם של האתר.

תוכל למצוא קישורים לקבוצות טלגרם בקישור הבא

5. שינוי ה-DNS של גוגל

אם אתה מנסה למנוע גישה לדומיינים של SDAROT TV, ודא שהגדרות ה-DNS של Google השתנו.

זה יאפשר לכם לבקר באתר סדרות הטלוויזיה מבלי לעבור את התהליך המפרך של ניווט בין אתרי האינטרנט המרובים כדי למצוא את הקישורים ל- SDAROT TV

אם ספקי האינטרנט בישראל חוסמים את אתר sdarotTVseries.com, ניתן לפתור בעיה זו על ידי שינוי הגדרות ה-DNS שלהם.

סרטון המסביר כיצד לשנות את ה-DNS של גוגל

6. הורד את האפליקציה

אם שיטה כלשהי לא עבדה עבורך, אז פשוט הורד את האפליקציה

שיטה זו פועלת בצורה חלקה ומאפשרת למשתמשים לצפות בסרטים מבלי לנווט בין אתרי האינטרנט הרבים המספקים כיום שירותי צפייה ישירה בסרטים בישראל.

כמו כן, מאחר ובאתר SDAROT TV עובדים בימים אלה על פיתוח אפליקציה שתאפשר למשתמשים בו לצפות בכל התוכן שלו, שיטה זו תאפשר לכם ליהנות מחוויית הצפייה המקוונת הטובה ביותר.

7. שימוש בשירות VPN

שירות VPN גם הוא דרך מצוינת לעקוף את ספקיות האינטרנט הישראליות ולאפשר למשתמשים לגשת לשירותי צפייה ישירה בסרטים השונים.

אתה יכול להשתמש ב-VPN פשוט או שאתה יכול להשתמש בתוסף דפדפן, רשימה של שירותי VPN בחינם לשימוש:

תכנים מומלצים לצפייה לקהל בוגר

רבים יעידו כי זה לא פשוט למצוא סדרה איכותית שיכולה להעביר את הזמן בכיף ובצורה מעניינת. קהל בוגר שרוצה להעביר את זמנו הפנוי בצפייה בתכנים איכותיים יכול לקחת בחשבון את ההמלצות שלנו. כל אחת מהסדרות הללו הצליחה בצורה בלתי רגילה, עד כדי כך שהן נחשבות לשם ודבר ברחבי העולם כולו.

חשוב לזכור שלכל אחד יש את הז׳אנר המועדף עליו, כפי שכבר הזכרנו, ועל כן זה יהיה נכון לצפות בתכנים שונים, לראות מה מעניין אתכם, ובהתאם לכך להחליט במה אתם מעדיפים להמשיך לצפות או האם יש סדרה אחרת שתרצו לצפות בה.

חברים

סדרה אמריקאית פופולארית במיוחד שעוסקת ב-6 חברים ובאינטראקציה ביניהם בשלל סיטואציות מצחיקות. הסדרה שודרה בין השנים 1994 ל-2004. שידורים חוזרים של פרקי הסדרה משודרים ברחבי העולם כולו, ואף במקומות הנידחים ביותר שאפשר לחשוב עליהם, וכל זה בשל החן שטמון בה, החברות בין הדמויות וההשפעה התרבותית שלה. לדוגמה, עיצובו של בית הקפה בסדרה שימש דוגמה לבתי קפה ברחבי העולם כולו, אשר בחרו לקחת ממנו השראה.

המפץ הגדול

סדרת הסיטקום המפץ הגדול חוותה הצלחה אדירה מאז שידור הפרק הראשון שלה, בתאריך 24 בספטמבר 2007. הסדרת עוסקת בחמש דמויות אשר מתגוררות בקליפורניה – שלדון, לאונרד, הווארד, ראג׳ש ופני. איימי וברנדט אלו הן שתי דמויות שמצטרפות לתכנית בהמשך. אם לומר זאת בקצרה, הסדרה מביאה עמה סיטואציות מצחיקות מחייהם של חנונים ומהאינטראקציה שלהם עם אנשים אחרים. המוזרות החברתית של ארבעת הגברים מובילה לשלל מקרים מצחיקים ומוזרים ששווים צפייה.

אבא אמריקאי

הפרק הראשון של אבא אמריקאי שודר בשנת 2005, 6 בפברואר, לאחר הסופרבול. מדובר בסדרת אנימציה סאטירית שעוסקת בסוכן ה-CIA סטן סמית׳ וביחסיו עם משפחתו, שכניו וקרובי משפחתו. הפרקים בסדרה נוגעים בנקודות רגישות בתרבות האמריקאית ומשלבים בין יחסי משפחה לכאורה נורמטיביים לבין שלל מקרים שבהם נתקלים בני המשפחה. לסדרה יש כבר 18 עונות והיא נחשבת להצלחה אדירה לא רק בארה״ב, אלא בעולם כולו.

סדרות מומלצות לילדים ונוער

דרגון בול

סדרת אנימציה שנחשבת לשם ודבר בישראל ובעולם. הסדרה עוסקת בגוקו, בני משפחתו וחבריו ובמהלכה אנו נחשפים לניסיונותיהם להגן על כדור הארץ מפני הנבלים. ההצלחה של הסדרה הובילה את היוצרים ליצור משחקי וידאו ועוד שלל עיבודים הסובבים סביב העולם של הסדרה המקורית.

פוקימון

אחת הסדרות הפופולאריות ביותר של שנות ה-90. כל ילד שגדל באותה תקופה מכיר את הסדרה, בה לוכדים מפלצות קטנות וחמודות שנקראות פוקימונים. במהלך השנים הסדרה צברה פופולאריות ויוצריה הוציאו משחקי קלפים, סרטים ושלל משחקי וידאו. לסדרה עונות רבות, כאשר היא ממשיכה להיות משודרת עד היום, עם עונות ופרקים חדשים.

דיג׳ימון

בדומה לסדרה פוקימון, גם הסדרה הזו עוסקת באינטראקציה שבין דמויות אדם לבין מפלצות שמסוגלות לעבור אבולוציה ולהתחזק. מדובר בסדרה מדהימה שמתאימה גם לקהל הבוגר, ולא רק לילדים, בשל העומק הרגשי שלה והמסרים שעוברים בה. באתר SDAROT TV ניתן לצפות בה.

קבוצת הטלגרם של סדרה

כאן באתר שלנו יש מגוון קבוצות טלגרם בהן תוכלו למצוא מאות סדרות וסרטים לצפייה ישירה שיכולים לשמש אתכם כתחליף ראוי לאתר סדרות.

באתר שלנו תוכלו למצוא קישורים לקבוצות טלגרם על הסדרה בקישור הבא בקישור הבא

מדריך וידאו לצפייה בסדרה בחינם

Also read little bit about netflix series from here

רשימה של ערוצי טלוויזיה חיים שניתן לצפות בהם ישירות

מה שאתה חייב לראות ב-sdarot.tv

סדרות טי וי קישור לצפייה ישירה סדרת בני

דרמת הפשע מספרת את סיפורם של שכונת בני אור בבאר שבע וקבוצת תלמידי תיכון שהופכים לסוחרי סמים ועבריינים בכירים בבירת הנגב

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת פלמ”ח

עלילת הסדרה מספרת על גורלה של המדינה לפני הקמתה ב-1946 ומשודרת ביס משנת 2020.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת אופריה

באופוריה, קבוצה של תלמידי תיכון חווים אהבה וידידות בסביבה של סמים, מין, טראומה ומדיה חברתית.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת בית הנייר

2.4 מיליארד יורו מממשלת ספרד נמצאים בידיה של קבוצת שודדים המנסה את השוד המושלם ביותר בתולדות ספרד.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת גולסטאר

‘גולסטאר’ היא תוכנית דוקו ריאליטי ישראלית המשודרת בשידור חי.

קבוצת כדורגל עם מפורסמים וידוענים אותה מאמן שייע פינגבוים מוצגת בתוכנית ולבסוף משחקת משחק גמר עם שייע פינגבוים

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת הגדול

תוכנית הריאליטי הישראלית האח הגדול משודרת בערוץ 13 וכוללת עד 20 משתתפים למשך מספר חודשים בבית משותף ומשימות שונות לאורך העונה.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת הבוזגלוס

בוזגלוס היא תוכנית דוקו ריאליטי על יעקב וחני וארבעת בניהם, שחקני הכדורגל ממשפחת בוזגלוס.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת מסע

אזהרת מסע בנורבגית Abducted, Norwegian: Kidnapped היא סדרת דרמה ומתח ישראלית-נורווגית, שנכתבה על ידי רונית וייס ברקוביץ והתסריטאית הנורבגית קירה הולם ג’והנסון, בהפקת נטפליקס-באלפר ושודרה בהוט, בנטפליקס ב2022 ו-TV 2 נורבגיה. צולמה ברובה בישראל ובחלקה בנורבגיה, הסדרה מכילה ארבע שפות (עברית, אנגלית, נורווגית וערבית). סטיין כריסטיאנסן ואורי ברבש ביימו את הסדרה.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת נהדרת

sdarot world

תוכנית הסטירה הישראלית של ערוץ 12 לועגת לאירועי אקטואליה ופוליטיקה ברחבי העולם.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת ויקנגים

אנו מתוודעים לעולמו האכזרי והמסתורי של רגנאר לוטברוק, לוחם ויקינגי ואיכר שלהוט לחקור את החופים הרחוקים מעבר לאוקיינוס.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת מאיסטנבול

צוריאנה, זמרת צעירה ויפה, מתערבת בחייה של משפחת בוראן כאשתו של הבן הבכור פרוק, וכל סודות המשפחה נחשפים.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת לוציפר

לאחר שהפך למשרת בגיהנום, לוציפר מורנינגסטאר מחליט לבלות קצת זמן על כדור הארץ כדי להבין טוב יותר את האנושות. לוציפר מחליט לגור בלוס אנג’לס, עיר המלאכים.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

קישור לצפייה בסדרה הפלקון וחייל החורף

בעקבות אירועי הנוקמים: סוף המשחק, סם ווילסון / פלקון ובאקי בארנס / חייל החורף יוצאים להרפתקה עולמית שבוחנת את היכולות שלהם – ואת סבלנותם.

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות טי וי קישור לצפייה ישירה סדרת סופרמן ולויס

תוכלו לעקוב אחרי העיתונאי המפורסם המתמודד עם כל הלחצים והמורכבות הנובעים מהיותו הורה בחברה של היום.

רשימת סדרות פופולריות על סדרות הטלוויזיה שניתן לצפות בהן בחינם באתר sdarot.world

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

סדרות הטלוויזיה קישורים לצפייה ישירה הולכות ונעלמות

- סדרות טי וי סדרת קישור לצפייה ישירה נעלמים

- קישור לצפייה ישירה סדרת כפולה

- קישור לצפייה ישירה סדרת הבוזגלוס עונה 5

- קישור לצפייה ישירה סדרות אנימה יפנית

- קישור לצפייה ישירה סדרות טורקיות

- קישור לצפייה ישירה סדרת הזר

- קישור לצפייה ישירה סדרת מחברת המוות

- קישור לצפייה ישירה סויט

- קישור לצפייה ישירה נרקוס

- קישור לצפייה ישירה הטבח

אתר סדרות TV חזר לעבוד בשנת 2022 עם קישורים חדשים סדרות tv לצפייה ישירה

כדי לגשת לקישור עובד, גלול למעלה לראש העמוד

למה אתר SDAROT TV לא עובד

אנשים שהשתמשו באתר SDAROT TV כדי לחפש סדרות וסרטים ניסו לאתר אותו ולמצוא פתרונות שונים וקישורים לאתר ולא מצאו בגלל תביעת זכויות יוצרים מתחילת 2021. לכן, הכנו רשימה מסודרת של קישורים לגרסאות שונות של אתר SDAROT TV שעובדים ומכילים מידע על תוכן אתר SDAROT TV ללא גרימת נזק ובעיות לאתר עצמו.

People can also ask

אילו סוגי תוכן יש באתר סדרות הטלוויזיה

אתר sdarot כולל מגוון רחב של ז'אנרים כולל סדרות יפניות, ישראליות, טורקיות, אמריקאיות וסדרות אנימה. נכון לעכשיו, יש גם מספר סדרות וסרטים פופולריים זמינים.

כיצד לבטל חסימה של אתר סדרות טלוויזיה באנדרואיד

בדוק את הסרטון שלנו למטה כדי לפתוח את Sdarot.tv בעדכון האחרון לאנדרואיד:

https://youtu.be/rxC92ey8Vrw

האם סדרת טלוויזיה היא שירות בתשלום?

Sdarot TV מציעה תוכניות בחינם וגם בתשלום. התוכנית החינמית מספקות למשתמשים גישה לאוסף מוגבל של תוכניות טלוויזיה וסרטים, בעוד שהתוכנית בתשלום מספקת גישה לספריית התוכן המלאה.

באילו מכשירים תומכים?

Sdarot זמין במכשירים שונים, כולל סמארטפונים, מחשבים ניידים, טלוויזיות חכמות, Roku, Firestick וXbox.

האם זה בטוח לשימוש?

Sdarot מספקת למשתמשים דרך מאובטחת ואמינה לצפייה ישירה של הסדרות והסרטים האהובים עליכם. עם זאת, חשוב להיזהר מקישורים מזויפים ולהשתמש תמיד באתר הרשמי או באפליקציה כדי לגשת לפלטפורמה.

- Watch Live Sports On Strumyk Tv

- איך לצפות בנטפליקס בחינם ?

- מדריך הורדת סרטונים מטיקטוק בחינם

- Sratim.TV – סרטים לצפייה ישירה והורדת סרטים הוסר מהאינטרנט בשל הפרת זכויות יוצרים

- How to run a TV series website from the sdarot tv phone (the only one that works!!)

- Downloading a story from Instagram (anonymous)